In light of the Covid-19 pandemic, the Government announced in March that the launch of IR35 was being delayed by a year. The legislation had been due to take effect from 6 April 2020 but will now start from April 2021.

IR35 is designed to clamp down on workers who are self-employed contractors who set up a limited company (often referred to as a Personal Service Company or PSC) as a way to minimise their income tax and National Insurance liabilities, even though they work in such a way for their end client that might otherwise view them as an employee.

From April 2021 there will be a significant change meaning that the organisation the PSC/contractor works for will become responsible for determining the tax status of the contractor.

Where it is determined that a contractor is in fact an employee, the liability for tax and ni will move to the organisation receiving the service and will need to deduct tax and/or NI from the fees due before making the payment to the contractor.. However, if the organisation receiving the services of the contractor is deemed a small business*, then the responsibility for determining tax and employment status and paying NI and/or tax continues to be with the PSC/contractor.

Which companies will have to comply with IR35?

Until April 2021, only public sector organisations have had to comply, but from April onwards the legislation will also apply to the private sector. However, *small businesses will be exempt. IR35 will only apply to public sector organisations and private organisations that meet 2 or more of the following conditions:

- an annual turnover of more than £10.2 million

- a balance sheet total of more than £5.1 million

- more than 50 employees

What does all this mean for my business in reality?

- You will need to audit every contractor or self-employed individual you engage to decide whether they fall within the scope of IR35.

- Your contractors may not like your decision to tax them at source and threaten to leave or try to negotiate higher pay rates to cover their perceived loss. You need to be prepared for these discussions.

- Your contractors might choose to work at other small businesses to which the regulations do not apply. Losing them will mean you lose their skills – which may be critical in your industry. You will need to look at how to retain them or hire or develop new talent to replace them.

- Your contractors may try to argue that if they fall under the regulations, they also fall within scope of being a worker/employee with employment rights. This could place an obligation on you as the employer to pay holiday pay, sick pay, redundancy pay, NMW etc

Tax Status

Individuals are determined as either Employed or Self-employed for tax purposes

Employment Status (this may be different to tax status)

Individuals are determined as either Employed, Worker or Self-employed when considering their employment status

Personal Service Companies (PSCs)

- A contractor’s own limited company through which they provide their own labour and services

- Prior to April 2021 – the PSC/contractor determined their own tax status and made tax and NI payments themselves

Agencies that provide contractors to other organisations

- If the agency is paying the contractor and taxing them at source, IR35 will not apply.

Sole trader

IR35 rules will not apply to sole traders who do not work through a PSC, limited company or other intermediary. They can continue to calculate and pay income tax themselves as they currently do.

IR35 applies, so what do I need to do?

As the organisation that is the end user of the services provided, you are now responsible for determining employment status of the provider/contractor for tax purposes. If you determine that they have the characteristics of employment (despite them working through their PSC, limited company or other intermediary) then you will also be responsible for deducting their income tax and National Insurance contributions from their fees before you pay them.

What do I do to Determine IR35 Status? – Status Determination Statement (SDS)

As the organisation that is the end user of the services provided, you are required to formally assess the status of the contractor and issue a statement which contains your conclusions about their status – The Status Determination Statement (SDS). This must contain your reasons for your decision and show how you determined it. It is important to remember that the SDS process must be led by you as an organisation, while you should consult and include the contractor in discussions about the implications of IR35, you have the overall responsibility for making the decision on their status. You must communicate this decision to the contractor. If the contractor does not agree with your decision, the legislation sets out a disagreement process whereby you have 45 days in which to review the decision from the SDS.

How do we determine status?

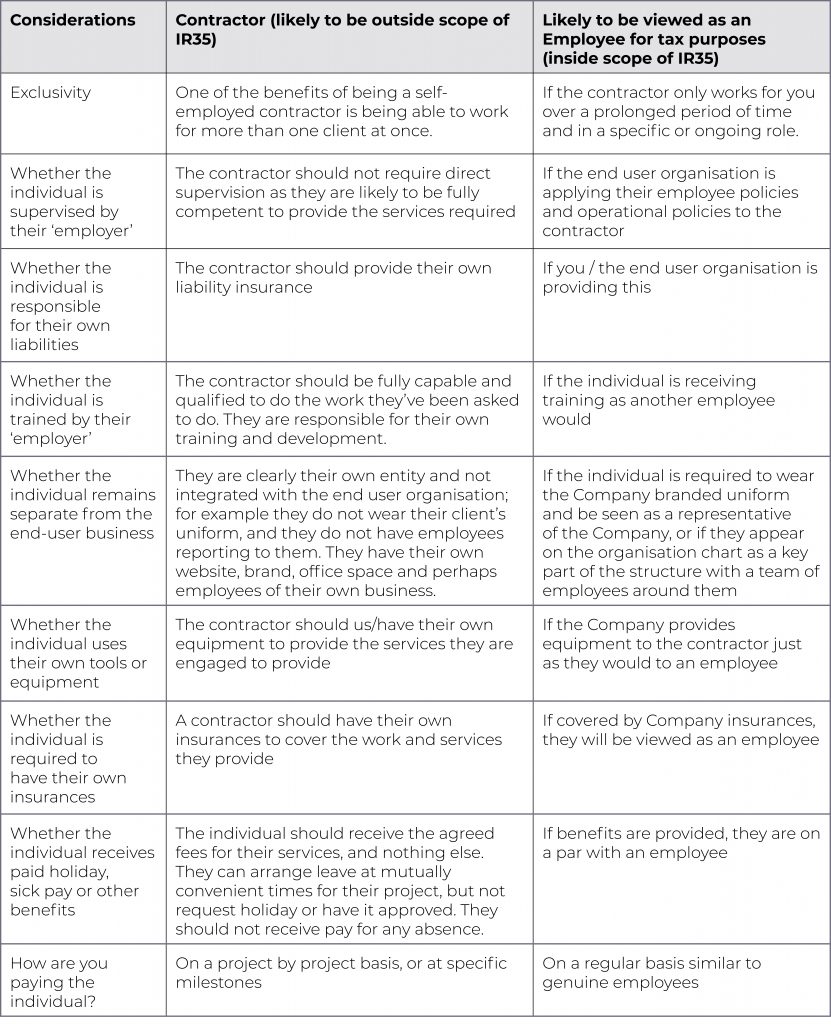

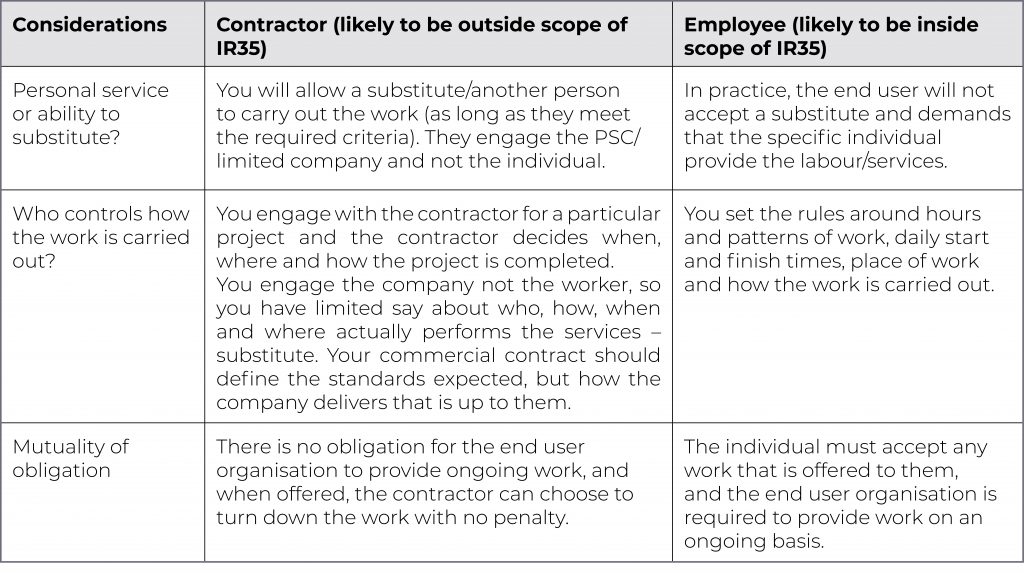

The initial key factors to consider are:

There are no clear-cut answers to determining someone’s tax status. A yes/no answer to one factor will not be decisive, and instead end user organisations are required to consider a broad number of factors and look at the true relationship in practice and in its entirety. You will then be required to document and justify what you have considered and how you have come to your decision. Additional factors to think about include:

I’ve determined them as an “employee” for tax purposes, does this mean they also have employment rights?

Perhaps. Although it is possible that an individual can have a different status for tax purposes and employment rights purposes. If you need help determining this, please get in touch with a member of our team.

Our contractual agreement states they are an external consultant / contractor so how can they be viewed as an employee?

The contract or agreement actually has little effect. What matters is how the relationship operates in practice, and how closely it resembles the relationship that genuine employees have with the end user organisation.

What if the contractor disagrees with the outcome of the SDS?

You need to follow the ‘status disagreement process’ where you have 45 days to review this after which you either need to change their status or provide information to support your original decision. Should you uphold a decision that they fall within IR35 and if they not comply with this decision, they may become liable for tax and ni.

What are the penalties for my business if I don’t do this?

It is believed that the HMRC will not impose any retrospective penalties if you determine a contractor as an employee from April 2021. However, if you are negligent in your SDS or try to hide the IR35 status, the HMRC will charge penalties. The legislation around IR35 states that you must take ‘reasonable care’ which means when determining the contractor’s status in undertaking the SDS it must be done as accurately as possible by a responsible person within the organisation. Taking specific legal/tax advice is likely to be seen as favourable in terms of acting reasonably but ultimately the liability rests with you as the organisation for making the final decision on status of the contractor.

So as a small business we won’t be affected?

There could still be some impact – but a positive one. Contractors who do not want to be taxed in this way by their large, end-user organisations who fall into the scope of IR35 may decide not to work with them any longer. Equally, end user organisations who don’t want the bother of complying with IR35 may end their engagement with contractors. This could mean that there is a larger talent pool of contractors for small businesses to benefit from.

We recommend you review the arrangements at least quarterly to see if any changes to your business mean you are no longer exempt.

How can I avoid falling into the scope of IR35?

- Reorganise the way the contractor works so that they no longer fall within scope – however this will have other implications and cannot just be lip service, it must be demonstrated that these different working arrangements really are in play

- Suggest the contractor approaches their own accountant / tax advisor and ask them for suggestions to a solution that is both compliant and suits the hirer

If you would like more information about IR35, please contact us at info@realityhr.co.uk or speak to a member of the team on 01256 328 428